Source: Newsroom

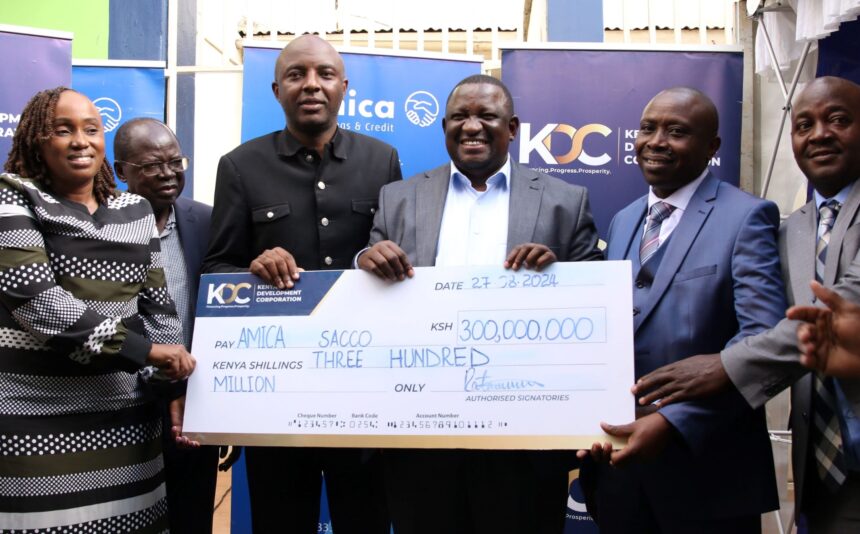

The Kenya Development Corporation (KDC) has provided a Sh300 million credit facility to the Murang’a-based savings and credit cooperative, Amica Savings and Credit Ltd, marking a significant deal that will enable the Sacco to extend loan facilities to its members.

During the ceremony held at Amica Sacco’s headquarters, the Chief Executive Officer, Dr. James Mbui, highlighted that the loan facility would strengthen the Sacco’s capacity to empower local businesses, particularly in the agriculture, trade, and manufacturing sectors.

“This loan facility will greatly contribute to our strategic goal of fostering a culture of excellence within our institution, as we work towards achieving and potentially surpassing our Sh1.2 billion revenue target for the year,” said Dr. Mbui.

Under this arrangement, the State-owned development finance institution, KDC, has established a loan repayment period of 10 years—a first for a local Sacco under KDC’s Supporting Access to Finance and Enterprise Recovery (SAFER) Project.

SAFER, an initiative backed by the World Bank, is implemented by KDC with Sh8 billion in funding aimed at addressing the significant financial challenges faced by Micro, Small, and Medium Enterprises (MSMEs) in Kenya, particularly in response to the impacts of the COVID-19 pandemic.

The project provides liquidity support to SMEs, reduces lending risks by strengthening the national credit guarantee, and offers technical assistance and project management to participating financial institutions (PFIs), including regulated SACCOs, Micro Finance Banks, and Commercial Banks.

“The KES 300 million facility represents a crucial investment in the future of Murang’a County. It will enable Amica Sacco to offer vital support to local businesses as they recover and expand, stimulating economic activity and driving overall community prosperity,” stated KDC’s Director-General Norah Ratemo during the cheque presentation in Murang’a.

She further emphasized that the pandemic had intensified existing market failures, severely restricting MSMEs’ access to the essential credit needed for sustaining and growing their businesses.

The SAFER project spans 25 years, with the first five years focused on implementation, and is organized into three interconnected components: liquidity support, de-risking lending, and providing technical assistance.

KDC revealed that it has received 41 applications amounting to Sh15 billion in loan requests from various entities, indicating a growing demand for loans amidst an unstable economy and unpredictable tax policies. It was noted that about four counties have already benefited from these credit facilities.

Cabinet Secretary for the Ministry of Investments, Trade, and Industry, Salim Mvurya, highlighted that these microloans will continue to be tailored for individual microenterprises, with a maximum repayment duration of 18 months. Meanwhile, small enterprises accessing loans through SAFER will benefit from a longer repayment period.

Mvurya further noted that this initiative is part of an ongoing effort to provide Kenyans with more accessible and affordable credit, with a particular focus on areas designated as arid and semi-arid.

“In particular, the Drive initiative aims to unlock the vast potential of Kenya’s pastoral economies, while SAFER—a partnership involving the National Treasury, the World Bank, and KDC—focuses on bolstering micro, small, and medium enterprises.

To date, Drive and SAFER have functioned as complementary efforts, providing essential financial support and technical assistance to enterprises impacted by the post-pandemic economic downturns,” said Mvurya.

“This aligns with our mission to offer innovative and accessible financial solutions to our members, contributing to their socioeconomic well-being. Beyond financial support, KDC is also instrumental in helping us align our business operations with Environmental, Social, and Governance (ESG) standards.

This will ensure that our financial solutions not only drive economic progress but also enhance sustainability and ethical impact,” added Amica Sacco’s National Chairman, Jediel Kahungu.